Check your insurance plan’s formulary. This document lists covered medications and their respective cost-sharing tiers. Knowing your tier (e.g., preferred, non-preferred, specialty) immediately clarifies your out-of-pocket expense.

Contact your insurance provider directly. A quick phone call or online portal check provides precise details on your copay, coinsurance, and any applicable deductibles for Cialis. Don’t hesitate; clarity saves money.

Explore manufacturer coupons and savings programs. Many pharmaceutical companies offer assistance programs to reduce medication costs. These programs frequently decrease the price significantly, even below your copay.

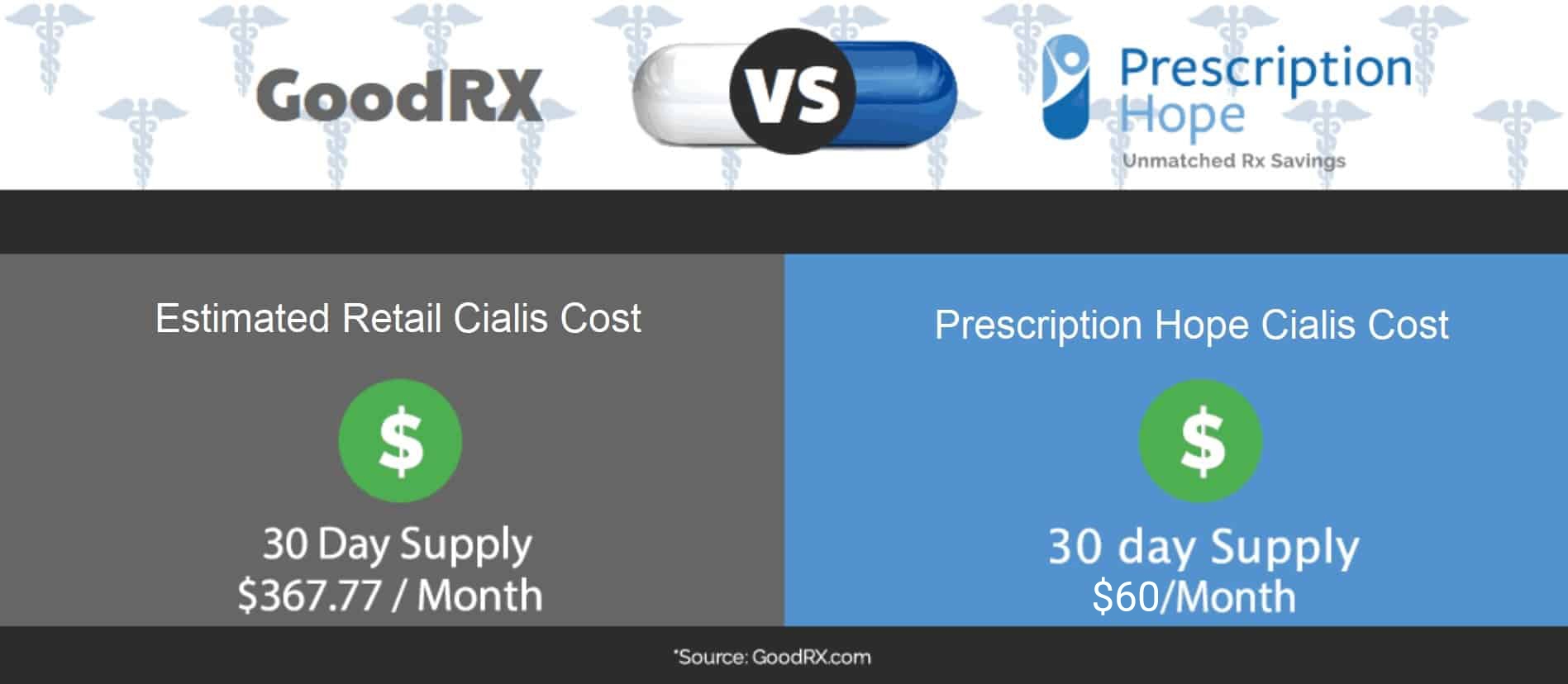

Consider using a prescription discount card. Independent pharmacy discount cards sometimes offer lower prices than insurance co-pays, especially for medications not on your plan’s preferred list. Compare prices to determine the best option.

Compare pharmacy prices. Costs vary between pharmacies, even within the same insurance network. Check prices at several pharmacies near you, including both chain and independent options, before filling your prescription.

Remember: Prices change. Always verify costs before filling each prescription to avoid unexpected expenses. Proactive price checking is key to managing your healthcare budget effectively.

- Cost of Cialis Prescription with Insurance

- Factors Affecting Cialis Cost

- Tips for Lowering Costs

- Factors Affecting Cialis Cost with Insurance

- Your Plan’s Copay and Deductible

- Generic Alternatives

- Quantity Prescribed

- Mail-Order Pharmacies

- Finding the Lowest Cialis Price with Your Insurance

- Use Your Pharmacy’s Website or App

- Compare Prices Across Pharmacies

- Explore Generic Options

- Consider a 90-Day Supply

- Negotiate with Your Pharmacy

- Check for Manufacturer Coupons or Savings Cards

- Explore Patient Assistance Programs

- Ask Your Doctor About Alternatives

- Understand Your Copay and Coinsurance

- Understanding Your Insurance Coverage for Erectile Dysfunction Medications

- Comparing Cialis Costs with Other ED Treatments

Cost of Cialis Prescription with Insurance

Your out-of-pocket Cialis cost depends heavily on your specific insurance plan. Generic tadalafil, the active ingredient in Cialis, is significantly cheaper than brand-name Cialis. Expect to pay anywhere from $0 to $100 or more per prescription, depending on your copay, deductible, and whether your plan covers generic medications. Check your formulary to see the specific cost for your plan.

Factors Affecting Cialis Cost

Several factors influence the final price. Your insurance tier for Cialis (tier 1, 2, 3, etc.) determines your copay. Higher tiers mean higher copays. Your deductible must be met before most insurance kicks in, leading to higher upfront costs until that threshold is reached. If your insurance prefers generic tadalafil, you’ll likely save money by choosing it. Finally, the prescription strength and quantity also affect the total price. Always compare prices with different pharmacies; costs can vary substantially.

Tips for Lowering Costs

Explore your insurance company’s website or member portal for details on coverage. Many pharmacies offer prescription savings programs or discount cards that can lower the price even further. Consider using a mail-order pharmacy, often offering lower prices for larger quantities. Discuss options with your doctor, including alternative medications or dosage adjustments, which may reduce overall medication costs. Prioritize your health, but smart comparison shopping ensures you pay the most affordable price.

Factors Affecting Cialis Cost with Insurance

Your Cialis cost depends heavily on your specific insurance plan. Different plans have varying formularies, determining which medications are covered and at what cost-sharing level. Tier placement significantly impacts your out-of-pocket expense; higher tiers mean higher copays. Generic tadalafil, if available and covered by your plan, will be considerably cheaper than brand-name Cialis.

Your Plan’s Copay and Deductible

Your copay is the fixed amount you pay per prescription, while your deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Meeting your deductible significantly influences your Cialis cost. Check your Summary of Benefits and Coverage (SBC) for specifics on your plan’s copay and deductible amounts for medications like Cialis.

Generic Alternatives

Generic tadalafil, the generic version of Cialis, is a cost-effective alternative. If your insurance covers it, expect to pay far less than for the brand-name medication. Consult your doctor about switching to a generic option. They can confirm your suitability for generic tadalafil and help you navigate the process.

Quantity Prescribed

The number of pills prescribed directly correlates with the total cost. Discuss with your physician the optimal prescription quantity based on your needs and budget, balancing efficacy with cost-effectiveness. A larger quantity might offer better unit price, but ensure it aligns with your treatment plan.

Mail-Order Pharmacies

Mail-order pharmacies often provide discounts on prescription medications, sometimes including Cialis. Compare prices from various mail-order pharmacies and your local pharmacy to determine the most economical option. Many insurance plans have contracts with specific mail-order providers.

Finding the Lowest Cialis Price with Your Insurance

Check your insurance plan’s formulary. This document lists covered medications and their cost-sharing tiers. Cialis’s tier directly impacts your out-of-pocket expense.

Use Your Pharmacy’s Website or App

Many pharmacies allow you to check prices online using your insurance information. Input your prescription details to get a personalized cost estimate before you visit.

Compare Prices Across Pharmacies

- Larger chains often have lower prices due to bulk purchasing power.

- Independent pharmacies may offer competitive pricing or special discounts.

- Consider using pharmacy comparison websites to efficiently scan prices from various providers.

Explore Generic Options

Tadalafil, the generic version of Cialis, is usually significantly cheaper. Ask your doctor if switching to the generic is medically appropriate for you.

Consider a 90-Day Supply

Purchasing a 90-day supply may sometimes reduce your per-pill cost compared to a 30-day supply. This depends on your insurance plan’s specific coverage details.

Negotiate with Your Pharmacy

If the price still seems high, politely inquire about potential discounts or financial assistance programs offered by the pharmacy itself.

Check for Manufacturer Coupons or Savings Cards

Pharmaceutical companies sometimes offer coupons or savings cards that can lower the cost of your prescription. Look for these on the drug manufacturer’s website or your pharmacy.

Explore Patient Assistance Programs

If cost remains a barrier, investigate patient assistance programs offered by the manufacturer or independent charities. These programs often provide financial assistance to those who qualify based on income or other criteria.

Ask Your Doctor About Alternatives

If cost is a significant concern, discuss alternative treatments with your doctor. They may have suggestions for similar medications or management strategies that are more affordable.

Understand Your Copay and Coinsurance

Familiarize yourself with the details of your insurance plan: how much is your copay, and what percentage of the cost will you be responsible for after meeting your deductible (coinsurance)?

Understanding Your Insurance Coverage for Erectile Dysfunction Medications

First, check your insurance policy’s formulary. This document lists covered medications and their tier levels. Cialis (tadalafil) might be on a higher tier, resulting in higher out-of-pocket costs.

Next, contact your insurance provider directly. Ask specific questions about Cialis coverage: What’s the copay or coinsurance for your prescription? Are there any prior authorization requirements? Does your plan cover generic tadalafil if available? This conversation will clarify your costs and any necessary steps.

Consider using your insurer’s online tools. Many plans offer websites or apps to check drug coverage and estimate costs before filling a prescription. This proactive approach helps you budget and compare options.

Explore potential cost-saving strategies. Ask your doctor about generic alternatives. Compare prices at various pharmacies; costs may vary. Consider using a pharmacy’s mail-order service; it can sometimes provide lower prices for prescription medications.

| Factor | Impact on Cost | Action |

|---|---|---|

| Insurance Plan Tier | Higher tiers mean higher costs. | Check your formulary. |

| Prior Authorization | May require extra paperwork. | Contact your insurer. |

| Generic Availability | Generics are usually cheaper. | Discuss with your doctor. |

| Pharmacy Choice | Prices vary between pharmacies. | Compare prices. |

Finally, remember your out-of-pocket maximum. Once you meet this limit, your insurance will cover the rest of your prescription costs for the year. Understanding your plan details empowers you to manage expenses effectively.

Comparing Cialis Costs with Other ED Treatments

Consider Viagra and Levitra as alternatives. Generic versions of all three medications often offer significant cost savings compared to brand-name Cialis. Check your insurance coverage for each; prices vary widely depending on your plan.

Generic options usually represent the most affordable approach. However, ensure your doctor approves the switch to a generic equivalent.

Stendra is another PDE5 inhibitor, but its cost can fluctuate considerably. Compare its price with Cialis, factoring in your insurance plan’s coverage. Direct comparison requires checking current drug pricing databases or contacting your pharmacy.

Beyond PDE5 inhibitors, explore alternative therapies like vacuum erection devices or injections. While these methods might not be covered by insurance, their upfront costs could be lower than long-term medication expenses. Your healthcare provider can discuss the benefits and potential drawbacks of each option.

Avanafil (Stendra) typically has a faster onset of action than Cialis, but this doesn’t necessarily translate to better value. Analyze the total cost, including frequency of use and prescription refills, to make an informed decision.

Ultimately, the most cost-effective treatment depends on individual factors. Discuss your specific needs and financial situation with your doctor to determine the best ED treatment for you.